Free paycheck calculator georgia

All inclusive payroll processing services for small businesses. Free Georgia Payroll Tax Calculator And Ga Tax Rates.

Ga Food Stamp Calculator For 2022 Georgia Food Stamps Help

Federal Salary Paycheck Calculator.

. Paycheck Manager provides a FREE Payroll Tax Calculator with a no hassle policy. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. The results are broken up into three sections.

Heres a step-by-step guide to walk you through. Ad Compare This Years Top 5 Free Payroll Software. Ad Accurate Payroll With Personalized Customer Service.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Free Unbiased Reviews Top Picks. Employers also have to pay a matching 62 tax up to the wage limit.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia.

Use as often as you need its free. Why Gusto Payroll and more Payroll. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

Explore Tools That Allow You To Access Insights On Retirement Concerns. Just enter the wages tax withholdings and other information required. Paycheck Managers Paycheck Calculator is a free service available for anyone and no account is required for use.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. For 2022 the minimum wage in Georgia is 725 per hour. The Georgia state tax tables listed below contain relevent tax rates and thresholds that apply to Georgia salary calculations and are used in the Georgia salary calculators published on.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Ad This is the newest place to search delivering top results from across the web. Georgia Salary Paycheck Calculator.

Luckily our Georgia payroll calculator eliminates all typically the extra clutter related with calculating salaries so your administrative. Payroll pay salary pay check payroll tax. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Free Unbiased Reviews Top Picks.

Back to Payroll Calculator Menu 2014 Georgia Paycheck Calculator - Georgia Payroll Calculators. Get a free quote today. Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking To calculate a.

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. How to use Free Calculator. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is.

Some states follow the federal tax. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

Get an accurate picture of the employees gross pay. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Computes federal and state tax withholding for.

Below are your Georgia salary paycheck results. Medicare tax which is 145 of each employees taxable wages up to 200000 for the year. Get a free quote today.

The state tax year is also 12 months but it differs from state to state. Ad Compare This Years Top 5 Free Payroll Software. Georgia Hourly Paycheck Calculator.

Users input their business payroll data including salary information state pay. Content updated daily for ga payroll calculator. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Personal Finance Spreadsheet Personal Finance Planner Debt Etsy Video Video Budgeting Personal Finance Personal Finance Budget

Georgia Paycheck Calculator Smartasset

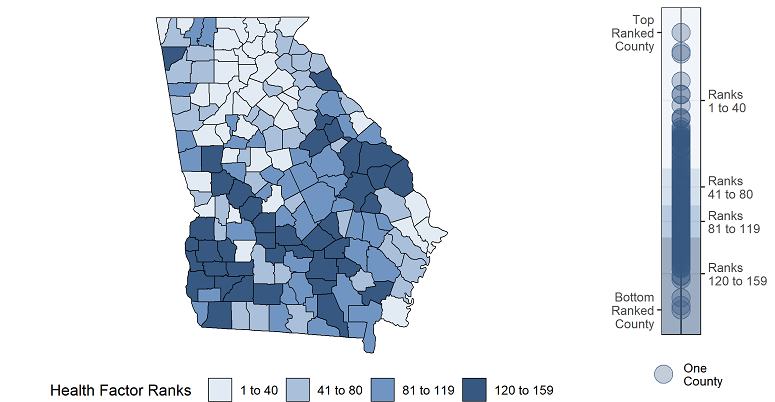

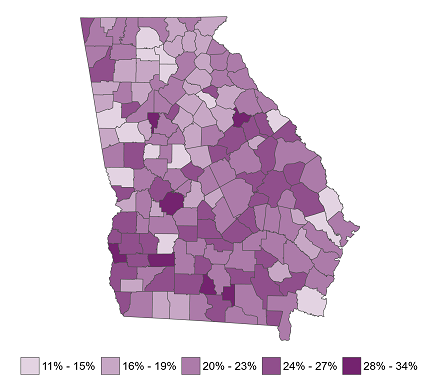

2022 Georgia State Report County Health Rankings Roadmaps

Ga Food Stamp Calculator For 2022 Georgia Food Stamps Help

Georgia Salary Calculator 2022 23

Georgia Paycheck Calculator Smartasset

Georgia Tax Tables Georgia State Withholding 2021

State Labor Law Georgia Homebase

Georgia Teacherpensions Org

North Carolina Usa Map North Carolina Usa North Carolina Goldsboro North Carolina

Georgia Paycheck Calculator Tax Year 2022

Georgia Sales Reverse Sales Tax Calculator Dremploye

2022 Georgia State Report County Health Rankings Roadmaps

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

How To Calculate Child Support In Georgia 2018 How Much Payments

Taxes Webinar Spring 2019 Uga Graduate Financial Education Program University Of Georgia Kaltura

Paycheck Calculator Take Home Pay Calculator